The Supreme Court heard oral argument in two fairly technical cases on Tuesday, one involving the appeal of a dismissal of an action that has been consolidated with other actions that are still ongoing and the other involving the the Railroad Revitalization and Regulatory Reform Act of 1976. Indeed, this week, the Court is knee deep in some very technical and complex areas of law. I’m predicting the winners of the Supreme Court cases based on the number of questions asked during oral argument. For more about this method, see my post on last Term’s Aereo case. For all of my predictions this Term, click here.

The first case, Gelboim v. Bank of America Corporation, asks whether and in what circumstances the dismissal of an action that has been consolidated with other suits is immediately appealable.

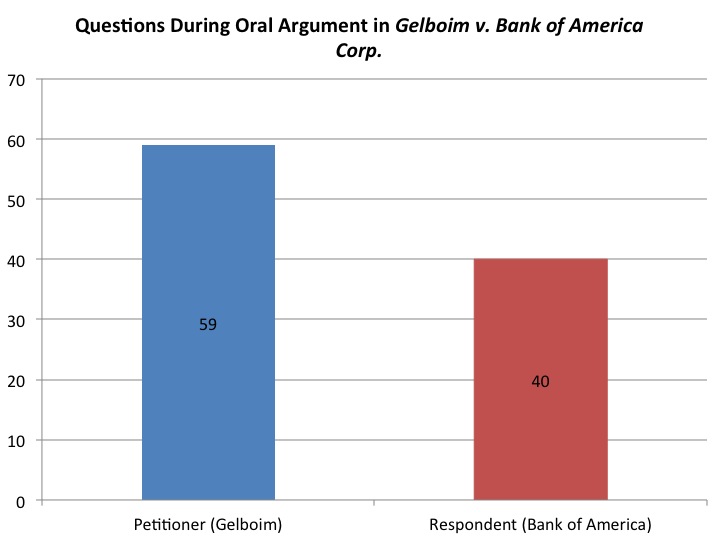

This case is easy to predict. As Figure 1 shows, the Court asked the Petitioner (Gelboim) 59 questions, 19 more than asked of the Respondent (Bank of America). The large disparity in questions indicates a victory for the Respondent, which argued that 28 U.S.C. § 1291 “bars an immediate appeal as of right when one constituent in a consolidated district-court action [in a Multi-District Litigation] is dismissed from ongoing pretrial proceedings”as the Second Circuit held below.

The second case, Alabama Department of Revenue v. CSX Transportation, Inc., asks (1) Whether a state “discriminates against a rail carrier” in violation of 49 U.S.C. § 11501(b)(4) when the state generally requires commercial and industrial businesses, including rail carriers, to pay a sales-and-use tax but grants exemptions from the tax to the railroads’ competitors; and (2) whether, in resolving a claim of unlawful tax discrimination under 49 U.S.C. § 11501(b)(4), a court should consider other aspects of the state’s tax scheme rather than focusing solely on the challenged tax provision.

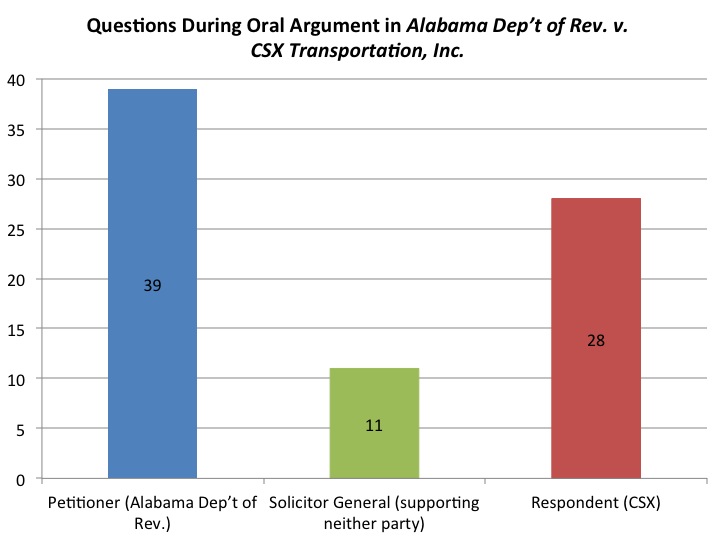

This case is more difficult to predict, given the two questions presented as well as the Solicitor General’s third position supporting neither party. The SG agreed with the Respondent that the proper comparison to determine discrimination against a rail carrier is compared to other competitors, but agreed with the Petitioner that “a state can justify a challenged tax’s differential treatment of railroads by pointing to an alternative and comparable tax that applies to the comparison class but not to railroads.”

If the SG were not involved, then I’d give the win to the Respondent (CSX), which was asked 9 fewer questions than the Petitioner, as shown by Figure 2 below. Since the SG agreed with the Respondent on the comparison issue, I predict a victory for the Respondent on that issue. But what about the justification issue—whose view will prevail? It’s too hard to say from just the number of questions, especially given that the Solicitor General received only 10 minutes as an amicus. But if I had to make a prediction on the second issue, I’ll go with the SG. So it’s a partial win for CSX.

One thought on “Predicting the Winners in Gelboim v. Bank of America and ADOR v. CSX”